SAN DIEGO (CBS 8) — Taxpayers hoping for an early tax return to help pay off holiday bills, may be disappointed this tax season.

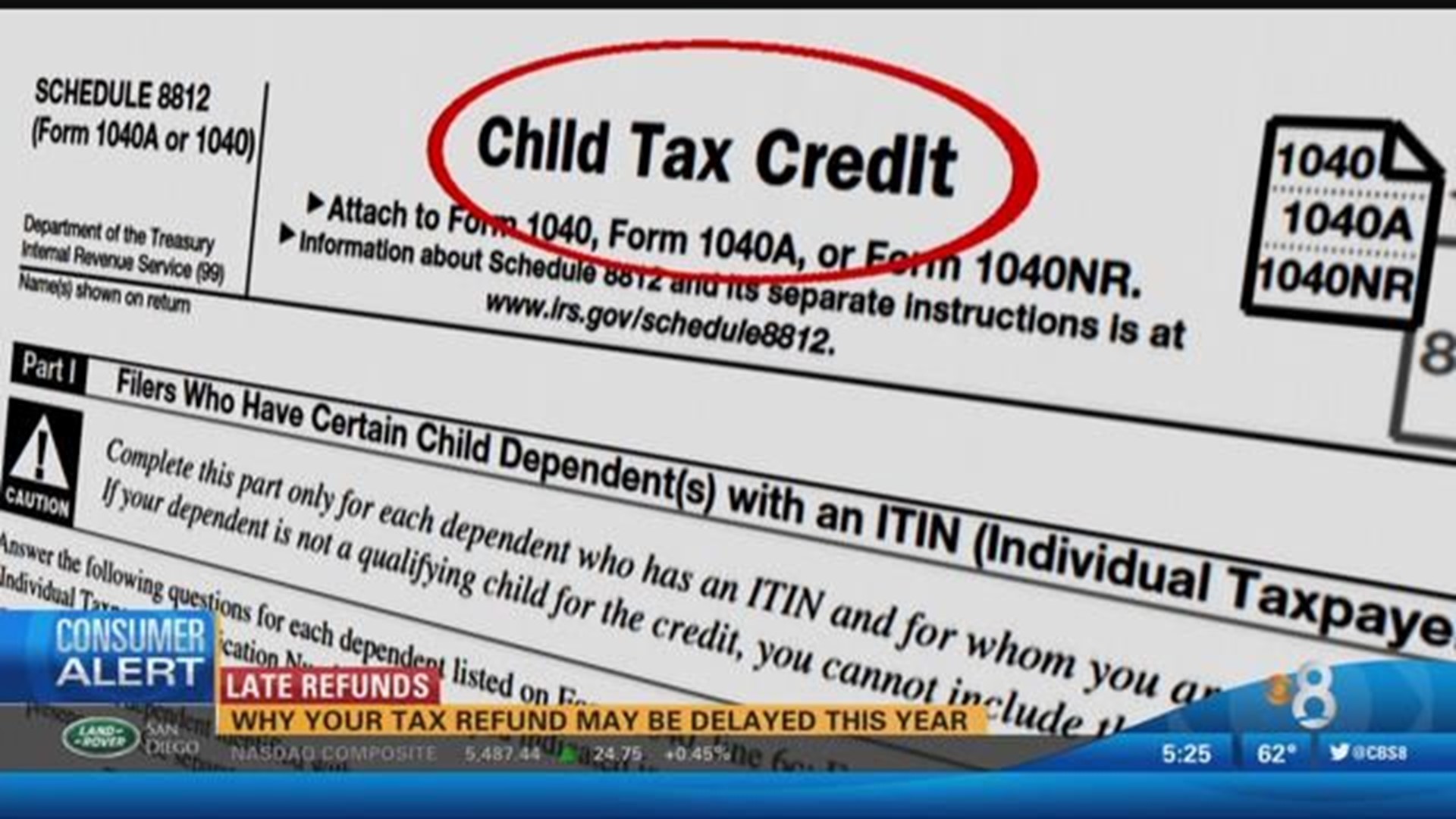

Due to a new law in the new year, the IRS says if you claim the "earned income tax credit" or the "additional child tax credit" your refund will be held until at least Feb. 15, which is a three-week delay. And that's if you file on the earliest day possible.

The delay, gives the agency more time to detect and prevent fraud.

If you don't claim either, you should get your refund sooner. Most should get a refund in 21 days or less if they aren't claiming these two credits.

And there are ways to help speed up the process.

E-filing and opting for direct deposit are the quickest methods for getting a refund.

The IRS says even if you file early, you should not count on actually seeing your refund until the week of Feb. 27.

You can check the status of your refund on irs.gov and on the IRS2Go mobile app.

Those resources will be available a few days after Feb. 15.