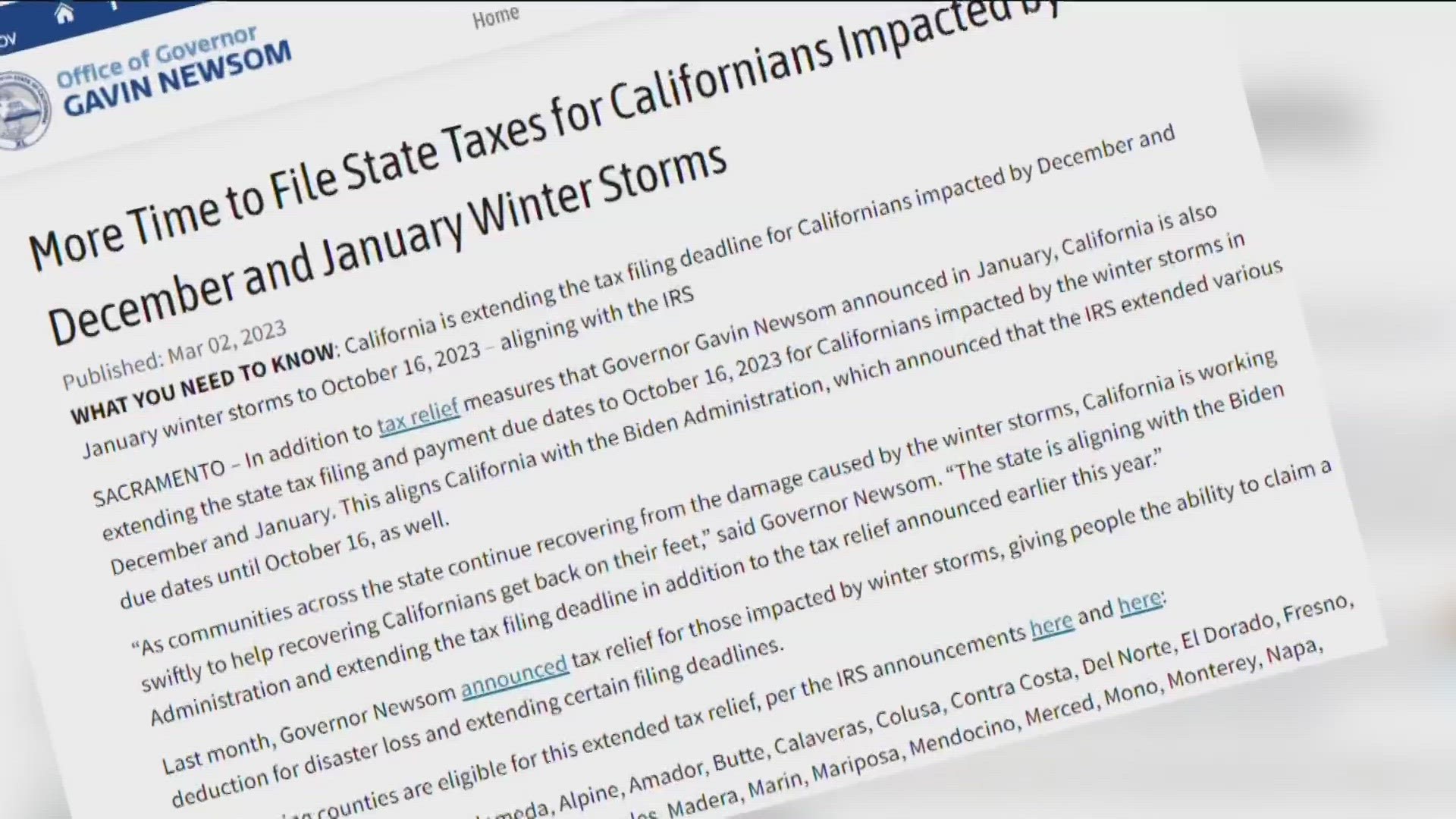

SAN DIEGO COUNTY, Calif. — California is extending the state tax filing and payment due dates to Oct. 16 for Californians impacted by this winter's storms, aligning with the IRS, which previously extended the federal tax filing deadline to Oct. 16 for the same reason.

"As communities across the state continue recovering from the damage caused by the winter storms, California is working swiftly to help recovering Californians get back on their feet," Gov. Gavin Newsom said. "The state is aligning with the Biden Administration and extending the tax filing deadline in addition to the tax relief announced earlier this year."

Last month, Newsom announced that those impacted by winter storms could claim a deduction for disaster loss, and extended filing and payment deadlines for individuals and businesses in California to May 15.

Those that live in San Diego County that do not have any storm damages or losses to report still have the October 16th deadline to file and pay their taxes.

The tax relief applies to nearly all of the state's 58 counties, including San Diego, Riverside, San Bernardino, Los Angeles and Orange counties. Imperial County is not included.

"In my 20 years of practice, I’ve never seen an automatic extension through October," said Casey Broach, certified financial planner for DA/CA Financial Group in San Diego.

The relief applies to deadlines falling on or after Jan. 8, 2023, and before Oct. 16, 2023, including the 2022 individual income tax returns that would have been due on April 18 and the quarterly estimated tax payments that would have been due on Jan. 17 and April 18, 2023.

California announced the extension in March. The IRS announced its extension in January.

WATCH RELATED: TurboTax shares tax tips ahead of filing deadline