SAN DIEGO COUNTY, Calif. — Although tax day is known to be in April, San Diego County got a special deadline this year. Monday, June 17 is the extended deadline for 2023 tax returns for all residents and businesses in the county. the IRS granted a two-month extension for disaster relief after the devastating floods in Jan.

"When FEMA steps in, the IRS steps in after it's declared, presidentially declared disaster area, and we provide tax relief usually in the form of extensions and postponements of deadlines," IRS spokesperson Raphael Tulino said.

The extension automatically applied to every taxpayer with an IRS address of record located in the disaster area. Contact the IRS if you live in San Diego County and received a late filing penalty to get it removed. If you haven't filed or paid your taxes yet, now is the time to do it.

"If you have a balance due you owe or you think you owe, then file the return and pay what you can and let's work something out going forward if you can't full pay," Tulino said. "It's the paying part that can get some folks in trouble with the penalties and interests that can accrue on the account."

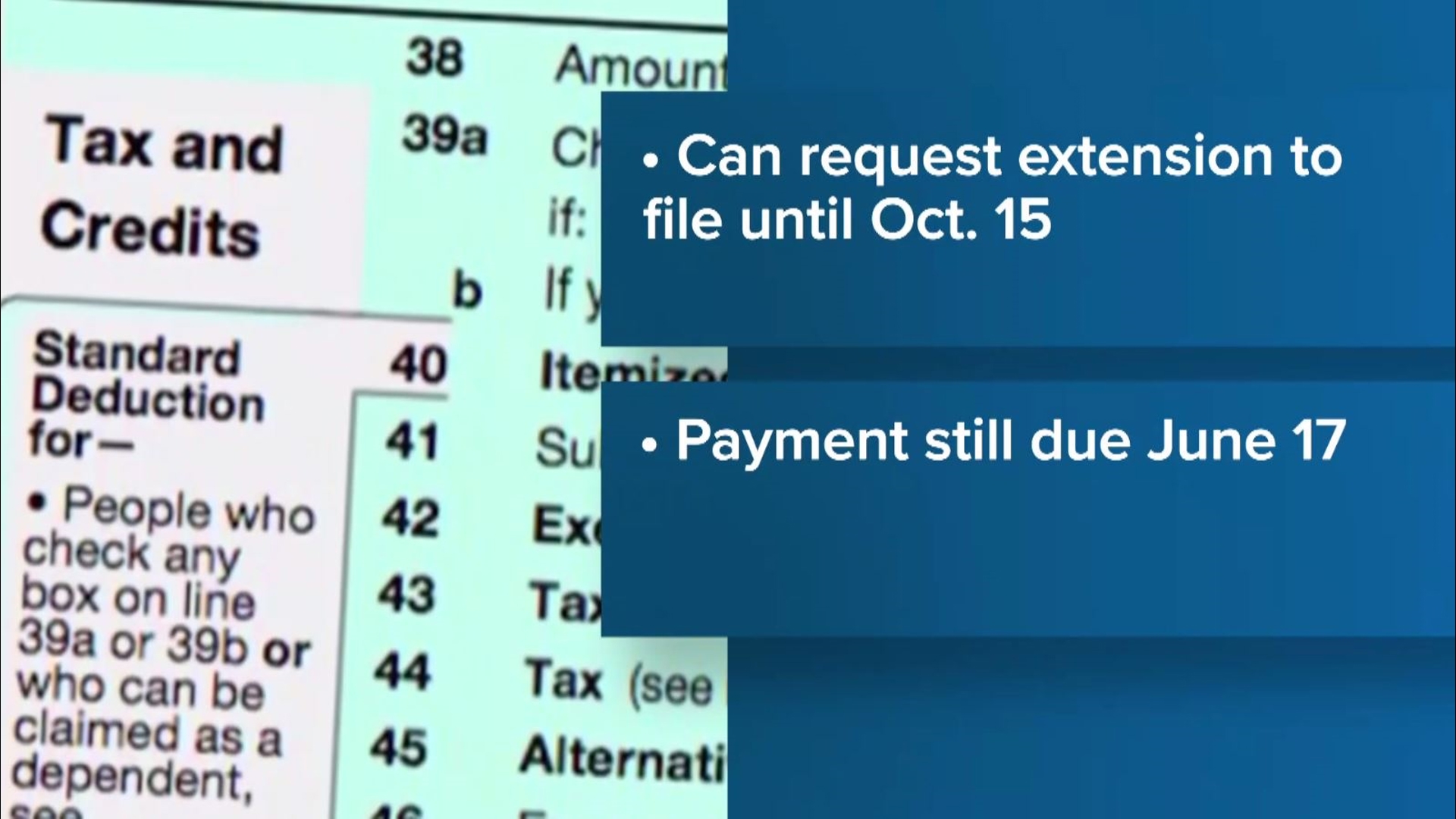

If you need more time to prepare your tax return, you can request a four-month extension to file your taxes until October 15. All tax payments are still due June 17.

"If it's a refund return, then you want to file it as soon as you can or when you're ready. That way, you get your government money back from the government in the form of a tax refund," Tulino said. "If you have a balance due, then that's where you might want to consider making some payments or full paying whatever you can do to avoid any more going down the line."

Whether or not you already filed for 2023, there's some things you can think about to make filing next year easier.

"The year is just about half over or so, and if you're thinking about taxes, not a bad idea to take a look at your withholdings, your taxes, your adjustments," Tulino said. "Maybe take a look at things now and consider some tax planning out the year is halfway over to bring the taxes you pay closer to what you actually owe."

WATCH RELATED: Tax Day is here, but San Diego County residents have until June 17 to file their taxes