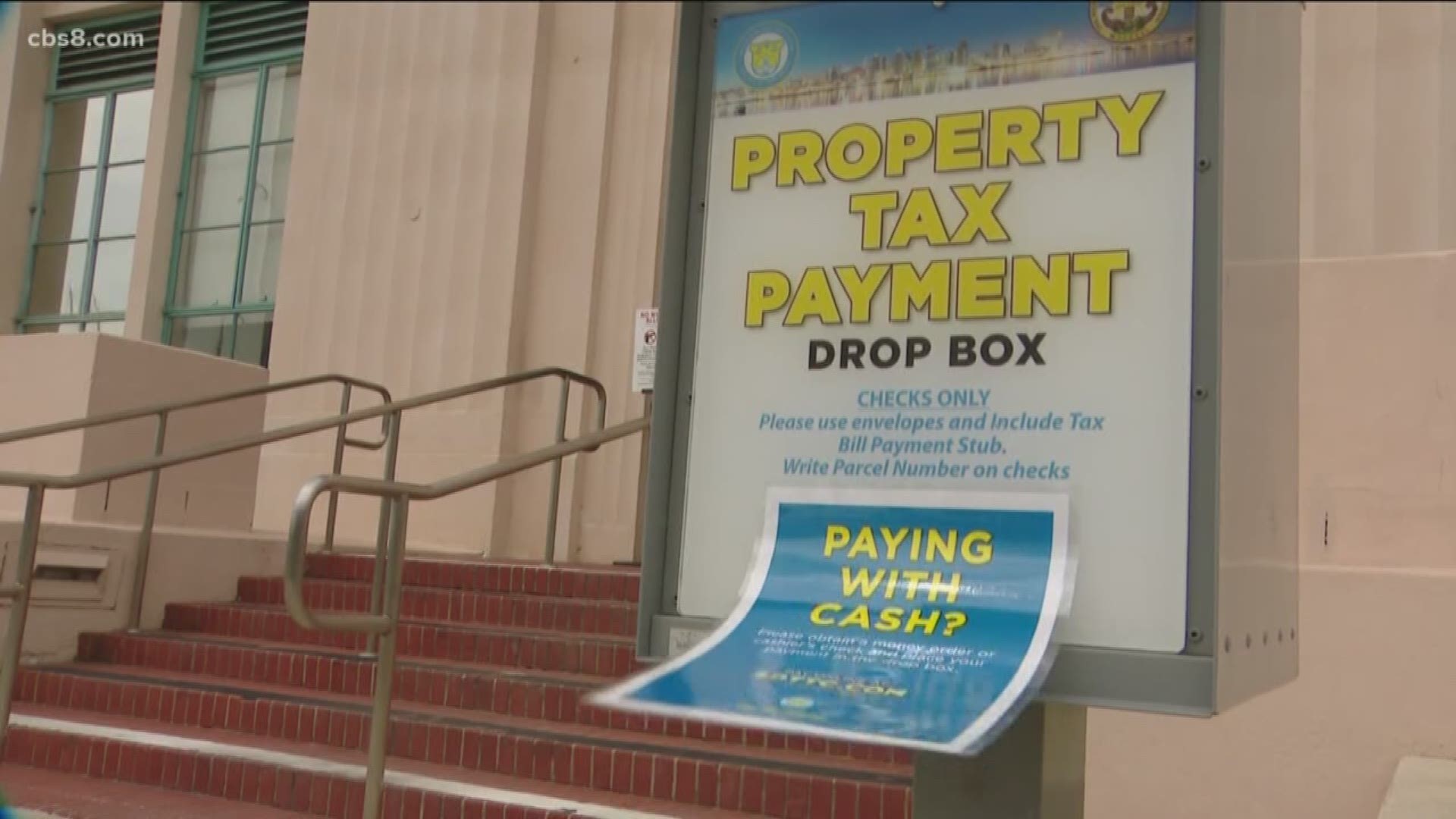

SAN DIEGO COUNTY, Calif. — An expensive deadline is looming for homeowners across the county. Property taxes are due this Friday. A handful of counties across the state have extended that deadline, but that’s not the case here in San Diego.

News 8 contacted the County Tax Collector’s office to ask why San Diego County isn't getting a break during these difficult financial times. A spokesperson explained that those other counties (San Francisco, San Mateo, etc.) have completely shut their tax collector offices down, but here in San Diego, employees are still showing up for work and can process payments.

With so many San Diegans facing layoffs and significantly reduced hours, paying property taxes is a major hardship. Several local politicians have asked County Tax Collector Dan McAllister to offer a break to residents.

“We want to remove any fees or penalties for people that can't pay them on time or give them some sort of relief or a payment plan - something to that effect,” said County Supervisor Jim Desmond in a video address Wednesday.

McAllister’s office said about 72% of residents have already paid their second installment, and they will consider canceling penalties for late fees on a case-by-case basis. Residents can fill out a form on their website.

McAllister's position has support from the California State Association of Counties and the California Association of County Treasurers who issued a joint statement saying in part:

“Property taxes only go to local governments - schools, counties, cities and special districts - not to the state or federal government, and directly fund education, health care, hospitals, welfare services, fire protection, and homelessness efforts, to name a few. Delaying the April 10 property tax payment would take tens of billions of dollars away from local government, create cash flow problems, and cause some to default on their loans, which would have significant long-term effects on all local agencies in California."

So, barring a last-minute change, property taxes in the county will still be due April 10.