SAN DIEGO — The holidays can be the best time of the year, if you don't slip into debt buying gifts for your loved ones.

If you're already there, the nation's largest non-profit credit counseling agency may be able to help.

Money Management International is a non-profit credit counseling agency that's been helping people improve their lives through financial education, since the 1950's.

"We help people struggling with credit card debt, housing, student loan issues, seeking bankruptcy perhaps and we give them solid financial advice, from a non-profit, who's here to help them," MMI President and CEO Jim Triggs said.

MMI helps tens of thousands of people every year. They counsel 12,000 people a month and about 45,000 consumers are paying off debt within five years through their debt management program.

"Only about 30-40% of the people go on a plan, so 60% of the people we talk to are getting free financial education and budgeting advice from us," Triggs said.

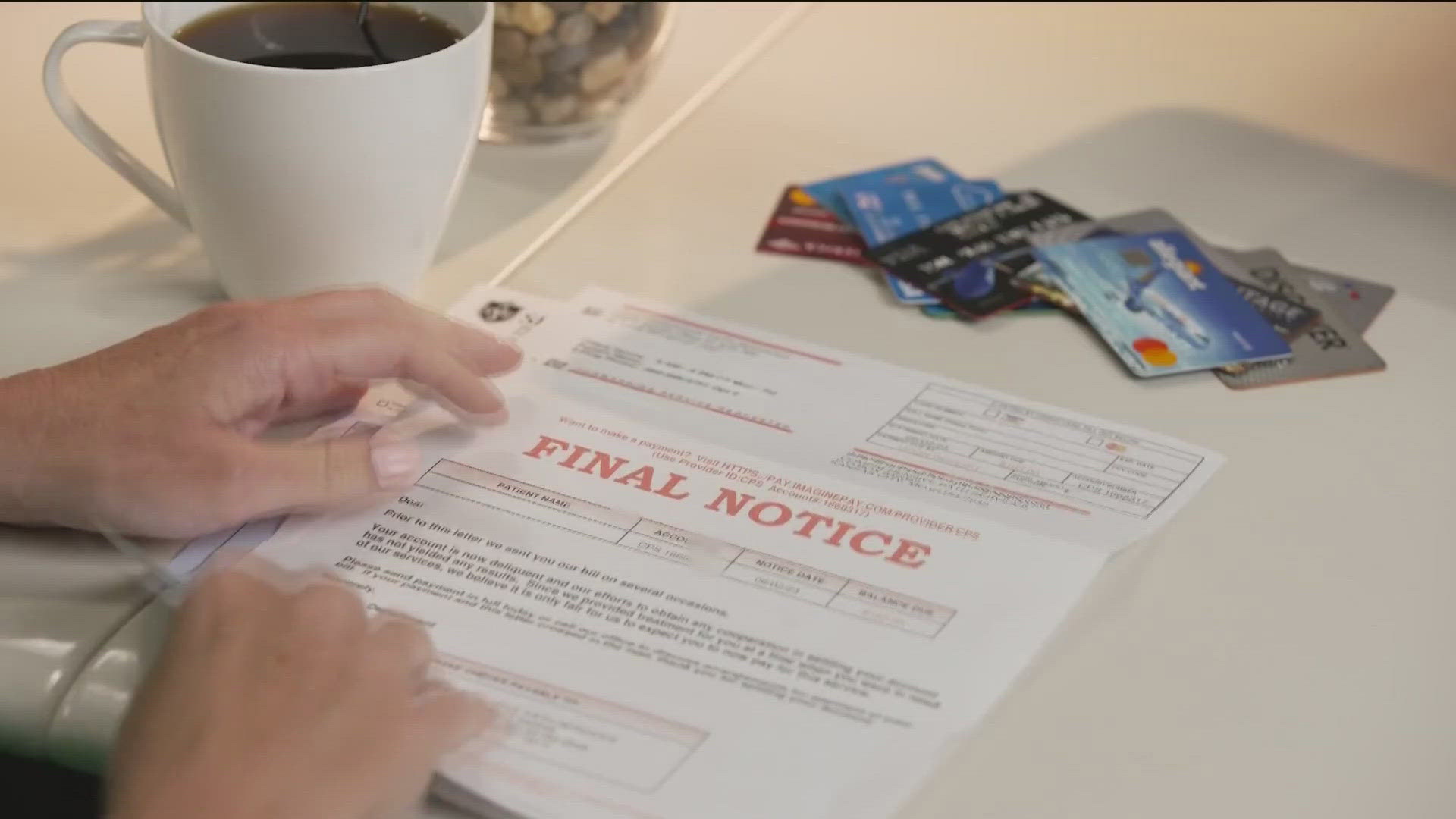

Matthew Reed was born and raised in the Vista-San Marcos area and he, like so many, found himself charging more than he could afford.

"I was able to get ahead a few times, fall behind a few times," Reed said. "The 10 dollars here, 15 there, starts to add up after a while."

He has a good job, but at one point had more than six credit cards, with a limit of $60,000. He had spent more $20,000 of it, not including his school loans. Reed says being in the hole started to take a toll.

"It's that internal stress, that you can or cannot share with people, that eats away at you," he said.

Reed ended up calling MMI two years ago and is now on track to be debt free by the end of 2025.

"My credit report is back to where it was, my credit score is great, all my negligences are gone, if I have a question they're quick to respond," Reed added.

MMI says the average consumer is carrying $30,000 in debt. Nationwide, we've accumulated $1.3 trillion in credit card debt, with the average interest rate over 20%.

"We have deals with all of the credit card companies, in some cases they'll drop your interest rate, in some cases to zero percent based on hardship," Triggs said. "They went from a $3,900 bill to an $1,800 bill on the debt management plan."

You can call or go online for a complete financial analysis, free of charge. One of their coaches will assess what's coming in and out to create a plan.

"It was lot of work on their end, not a lot of work on my end," Reed said. "You have this sigh of relief. 'OK I can see my path - it's right there. I just have to do the work and be done.'"

So know there's help out there, you're not alone and keep the focus on friends and family this holiday season.

"Do not go crazy over the holidays and charge, if you do not have a plan to pay it off very quickly," Triggs said.

Click here for more information: https://www.moneymanagement.org/