SAN DIEGO — Governor Gavin Newsom announced a new state initiative Thursday to help California small businesses. He also highlighted two federal programs, including one that provides up to $10 million in relief for those that keep paying their workers during the coronavirus pandemic.

As a former small business owner himself, Newsom said he understands the financial hardships hitting so many people in California, where he says 49 percent of all private sector workers are employed by small businesses.

To help small businesses keep more of their money right now, the governor announced owners do not need to make sales or use tax payments right now; The state is deferring payments of up to $50,000 for one year.

"In essence, it is a bridge loan. The money that you've already collected, you will not have to pay the state for 12 months. No penalties, no interest," Newsom said.

San Diego small business owner Stephanie Hess, CEO of Forward Path, said it's encouraging news.

"Even if it's $50,000, for some companies that's a tremendous amount of money, for other companies it's just a drop in bucket, but every drop in the bucket can help right now," Hess said. "I applaud California for saying, 'we're not only going to take what's coming from the federal government, we're going to help our citizens as well any way we can,'" she added."

Forward Path works with other small businesses to develop strategies for growth and success, but Hess says these days, she's just trying to help them survive through financial devastation.

"I encourage everyone to look at what's available and apply for it," Hess recommended. "You may not get it, and you may decide you don't need it, but if you haven't applied for it, you can't make a decision."

Hess has already applied for the Economic Injury Disaster Loan at the federal level, which Governor Newsom also highlighted on Thursday.

Newsom said, "You can get a $10,000 loan up front, as your application is being processed. You're presumed eligible for the dollars in that loan account." He said small businesses, including non-profit organizations, are eligible.

Newsom also advised businesses to take advantage of the Paycheck Protection Program for substantial financial relief through the Coronavirus Aid, Relief, and Economic Security Act, known as the CARES Act.

The program has set aside nearly 350 billion dollars for employers to take out loans or grants. The money is meant to help those small businesses stay open and incentivize them to keep their employees on the payroll.

Applications open on April 3rd.

"This provides businesses up to 10 million dollar loans, if you continue to pay your employees," Newsom said, adding, "You have to provide 75 percent of all of that loan benefit to your employees, to payroll."

The governor directed people to the website www.covid19.ca.gov for information on the state and federal programs.

Hess is thankful for the efforts of California state leaders. "I'm encouraged that they're taking such a proactive role in helping our businesses, because so much of California is small business," she said.

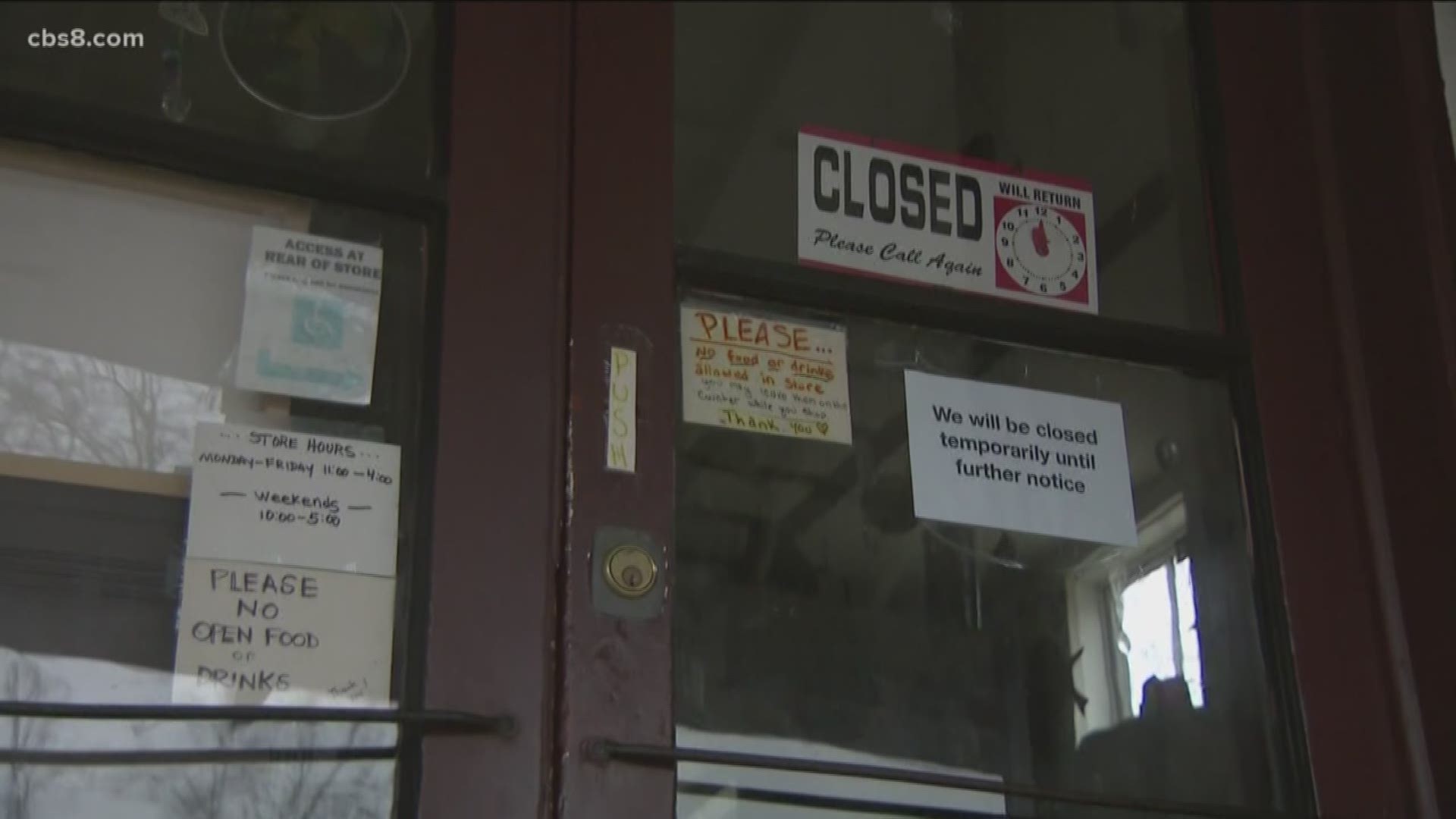

Locally, San Diego recently established a $6.1 million-dollar small business relief fund that will provide grants and microloans of up to $20,000 to help businesses with less than 100 employees. The fund is meant to help small businesses from closing due to the coronavirus pandemic.

Mayor Kevin Faulconer has said the demand is greater than the amount that is in the fund so he is already looking for more funding sources. The city has received more than 5,000 applications for the relief fund.

There are also funds set up for those in hard-hit areas like the Latino community. Workers who need help with utilities and other monthly payments can apply to receive money through the county’s COVID-19 Community Response Fund.