CALIFORNIA, USA — Scammers pulled off one of the biggest suspected frauds in U.S. history while laid-off workers scrambled to survive. A CalMatters investigation finds that the EDD missed red flags and failed to make long-promised changes before the pandemic — and that once the twin crises hit, the state and its top contractors kept making money but were slow to deliver relief.

April 20, 2020: Nine phone calls. The next week, another six calls from 28-year-old Shane Balogh’s cell phone to California’s jammed unemployment lines. One more in May. Another 22 in early and mid-June.

Patti Balogh is most haunted by the 17 calls her son made on June 24 to ask about the $11,700 that records on his phone show California’s Employment Development Department owed him after his traveling sales job disappeared with pandemic shutdown orders.

Three days later, she was jolted awake by a 4 a.m. phone call: Shane had died by suicide.

In the three years since then, Patti has tried, slowly and painfully, to understand what impact her son’s unemployment struggle might have had on his frame of mind. No answer will ever be complete, but she believes it was a collision of anxieties: financial stress from the missing payments, COVID’s social isolation and bigger concerns about the state of the world.

“I see now,” she said, “that it was a crisis of hope.”

In the fog of pandemic horror stories about drained life savings, mounting debt and lost homes, no official estimates have tallied the number of unemployed people who died by suicide. Public health studies on recessions show that such deaths — the most permanent and severe scars of economic crisis — usually involve a combination of personal, social and financial factors.

During the pandemic, as few as 1 in 1,000 calls to California unemployment phone lines were answered, state reports show. For those who did get through, EDD employees were required to report threats of violence: they tallied 483 threats of self-harm and 671 threats against the agency or its personnel from March 2020 through December 2022, according to state data requested by CalMatters.

The EDD declined to comment for this story.

Still, front-line EDD workers recall dire conversations with some of the 5 million Californians that state reports show got stuck waiting for delayed unemployment payments.

“We’re counselors along with everything else,” said Irene Green, an EDD employment program representative who is now vice president of bargaining for the Service Employees International Union Local 1000. “We get calls in with people that are saying, ‘I need my money because I’m being evicted.’ We’ve got people that are calling us saying that, ‘I’m at my last leg and I’m threatening to end my life.’”

-------------------------------

More than 40% of threats made to EDD were of self-harm, even more were against staff

From March 2020 through December 2022, the California Employment Development Department received 1,154 threatening phone calls.

483 threats of self-harm | 671 threats against EDD staff

-------------------------------

Many researchers emphasize that, when state unemployment programs worked, expanded pandemic benefits likely saved many people who could have otherwise been plunged into homelessness or financial ruin. It will take years, they say, to more fully understand the toll of isolation, lost jobs, lost education and pandemic trends toward spiking gun sales, substance abuse and an increase in some groups of thoughts about suicide.

“It’s really hard to predict who will be that person and who won’t,” said Amy Barnhorst, vice chairperson of community mental health at the UC Davis Department of Psychiatry. “That’s why a public health approach to preventing this is really important.”

In the three years since Shane died three days before his 29th birthday, Patti Balogh and her husband, Glen, have turned part of their family room into a memorial for the youngest of their three sons. Shane’s black glasses and name tag from his first job at In-N-Out sit beside a wooden box that holds his ashes and snippets of Biblical scripture they turn to for comfort.

“You have stored my tears in your bottle,” Patti’s favorite Psalm reads, “and counted each of them.”

On days she’s felt strong enough to look through Shane’s phone, the school nurse has written down all the calls her son made to the EDD on a small yellow notepad, looking for clues in frequency or time of day. She’s read the screenshots from his unemployment account, stray bank statements and social media posts he saved about the chaotic state of the world.

Glen, who is retired after 39 years as a civil servant with a local water district, understands the pressures and limitations of working for the public better than most. What happened with the EDD during the pandemic is still too much for him to take.

“People needed help, and my son needed help,” he said. “To me, you failed him. And that’s something that we can’t get back.”

Shane was born on June 30, 1991, named for his dad’s favorite Western about a humble gunslinger who defied a ruthless cattle baron. The world looked very different in the diverse, working-class corner of Southern California where Shane was raised, in a former post-World War II boomtown famous for its annual strawberry festival.

Early-’90s Garden Grove may be best known in pop culture for a Sublime song about the local party scene, but the Baloghs’ weeks revolved around Little League, church and family beach trips. Shane was a textbook little brother: outgoing, high energy, and happiest riding his bike or boogie-boarding.

“He could stay in the water, literally, four or five hours,” his dad remembers. “He wouldn’t come out to eat. Patti would have to drag him.”

School never came as naturally. Shane — who his mother said had attention deficit/hyperactivity disorder, commonly known as ADHD — was always bored in class, even though at home he was building computers. She found out later that he was bullied on the baseball team, and she was called in more than once for disciplinary issues.

Things seemed to get better when Shane switched to high school in Westminster. He started learning Vietnamese at school just down the street from Little Saigon’s banh mi and pho shops. When his parents bought him a 1967 Mustang for his 16th birthday, an outlet emerged for the “Mr. Fix-It” instinct Shane inherited from his dad

By the time Aaron Gibbs met Shane at Cypress College a few years later, they were competing for the honor roll in their automotive program. After class, they started an online neighborhood watch group, researched emergency preparedness and played airsoft shooting games with friends. Patti recalls “a big fight” when Shane decided to buy his first real gun at 21, but she was reassured when he was careful to keep it locked away.

When Shane was 25, he met a girl while volunteering at Habitat for Humanity. Soon, Patti was in the thick of three frantic weeks of wedding planning. They held the reception at a local park, complete with an elaborate spread of tacos and Vietnamese food cooked by his new wife’s family.

Glen drove the U-Haul when the young couple struck out on their own in the summer of 2017, to a new place near Phoenix, where Shane’s wife was starting a graduate program. Shane drove his prized possession: a shiny, gunmetal gray Mustang GT.

Before long, he was lobbying his parents to retire in Arizona.

“He wrote me a Mother’s Day card,” Patti recalled, “about looking forward to having us watch his children.”

When COVID struck in March 2020, Shane was still living in Arizona with his wife but working for an Orange County medical device company. He loved to travel to see new places and sell equipment to dentists and doctors, so it was a shock when everything shut down. Shane got laid off and filed for unemployment.

At first, it seemed like typical red tape when he didn’t get paid right away. Bank statements show Shane’s account was issued two $450 payments from the EDD in May, but then nothing. As the weeks dragged on, Shane told his family that he feared he’d made a mistake on his forms — he was confused about what to file where, but learned he was supposed to apply for benefits in California, where his company was based — and he couldn’t get through to the EDD to answer his questions.

He wasn’t alone.

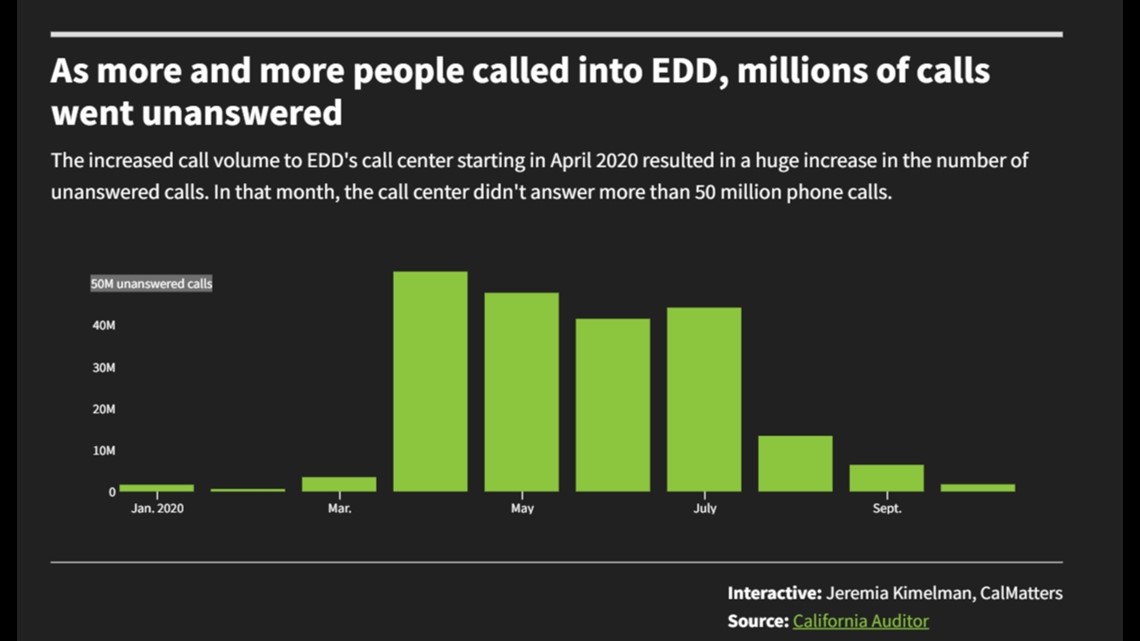

In April 2020, when Shane’s phone records show he started trying to reach EDD, the California state auditor found that the agency was answering less than 1 out of every 200 phone calls. The 800 number that Shane repeatedly dialed was worse. It came to be known in state reports as “call center 1.0,” but a governor-appointed task force found that the number actually dialed a Northern California EDD field office. The line rang up to 6.7 million times per week, but many employees were working from home or reassigned, so calls were rerouted to another call center — “call center 1.5” — where the task force found more dysfunction.

“We can safely estimate that no more than 1 in 1,000 people that are trying to reach this call center on a given day are getting through,” the task force reported in September 2020. “The morning our team visited this office, we observed four live phone calls in 90 minutes.”

The EDD now says that new call centers are a top priority for a five-year, $1.2 billion plan to overhaul the state’s employment safety net, called EDDNext. The agency attributed many of the unanswered calls to an exponential increase in call volume — as many as 60 million calls a month during spring 2020, the state auditor tallied, compared to about 2 million calls a month before the pandemic — as the EDD scrambled to staff emergency call centers.

“One of the best things that we can do for a recession, whenever that comes, is to have less reliance on the phones and more availability of things online,” EDD Director Nancy Farias said in an interview about the planned upgrades, since many workers have basic questions: “They just wanted to know where their check was.”

Shane’s parents say that he never asked for money or talked openly about how he was feeling. In retrospect, Patti could see perhaps he was going down online “rabbit holes.” Gibbs remembers Shane texting not just about his EDD frustration, but about things like voter fraud, protests and politics.

Still, his death by suicide was a shock.

A medical examiner’s report noted that Shane, who suffered a gunshot wound on June 27, 2020, was said to be “upset about the state of the world and the current pandemic.”

Just weeks after he died, his widow called to tell Patti that she got a notice that his nearly $12,000 in unemployment funds had been approved, though it would take months to sort through the paperwork.

“If only he’d waited two more weeks,” she told Patti.

Overall suicide rates dropped in California and across the U.S. in 2020, but the federal Centers for Disease Control and Prevention recently reported a spike to a record-high of nearly 50,000 nationwide suicides in 2022. Federal data shows that firearm suicides also surged to an all-time high in 2022. Suicides among older Americans have risen fastest, according to the CDC, but one Boston University survey found that suicidal ideation increased most dramatically during the pandemic for people who were young, low-income or Latino.

The American Foundation for Suicide Prevention stresses that a range of factors — anxiety, fear, isolation, substance use, access to lethal means and other circumstances — can all contribute to suicidal behavior. Assistance with meeting basic needs, effective mental health care, strong social connections and safe housing can decrease these risks.

Shane’s parents say he always felt pressure to provide financially since he started working at age 16, and studies show that men tend to heavily rely on work for social connection and purpose.

“We know from the research generally that financial downturns — and there is a gender effect particularly for men — increase suicide risk,” said Jonathan Singer, a professor at Loyola University Chicago who studies youth suicide. “During the pandemic, we also had sort of the forced social isolation, which for younger people translated into more loneliness.”

For Shane’s family and friends, the years since he’s been gone have brought different tides of grief.

It stung, badly, when the bank repossessed Shane’s Mustang. It was comforting when his wife paid off her car with the long-delayed EDD money. For his friend Gibbs, there’s still anger over how he feels Shane and others were left behind by their home state.

“I wish I had the balls to get out of this state and go with Shane to Arizona or another safe haven,” Gibbs said. “The way they look the other way on shit — it’s horrific.”

Patti and Glen have joined a group for people who have lost loved ones to suicide. They hope that Shane’s story will help prevent similar losses.

Patti plans to get Shane’s handwriting from one of the cards he wrote her tattooed on her arm.

Glen still says “Shane” when a restaurant asks for his name, so they call out “Party for Shane.”

If you or someone you know are struggling, call or text 988, text HOME to 741741 or visit 988lifeline.org.

WATCH RELATED: 'It's very embarrassing' | Lawmakers fear over $20 billion stolen from EDD, will never be recovered (October 2022)