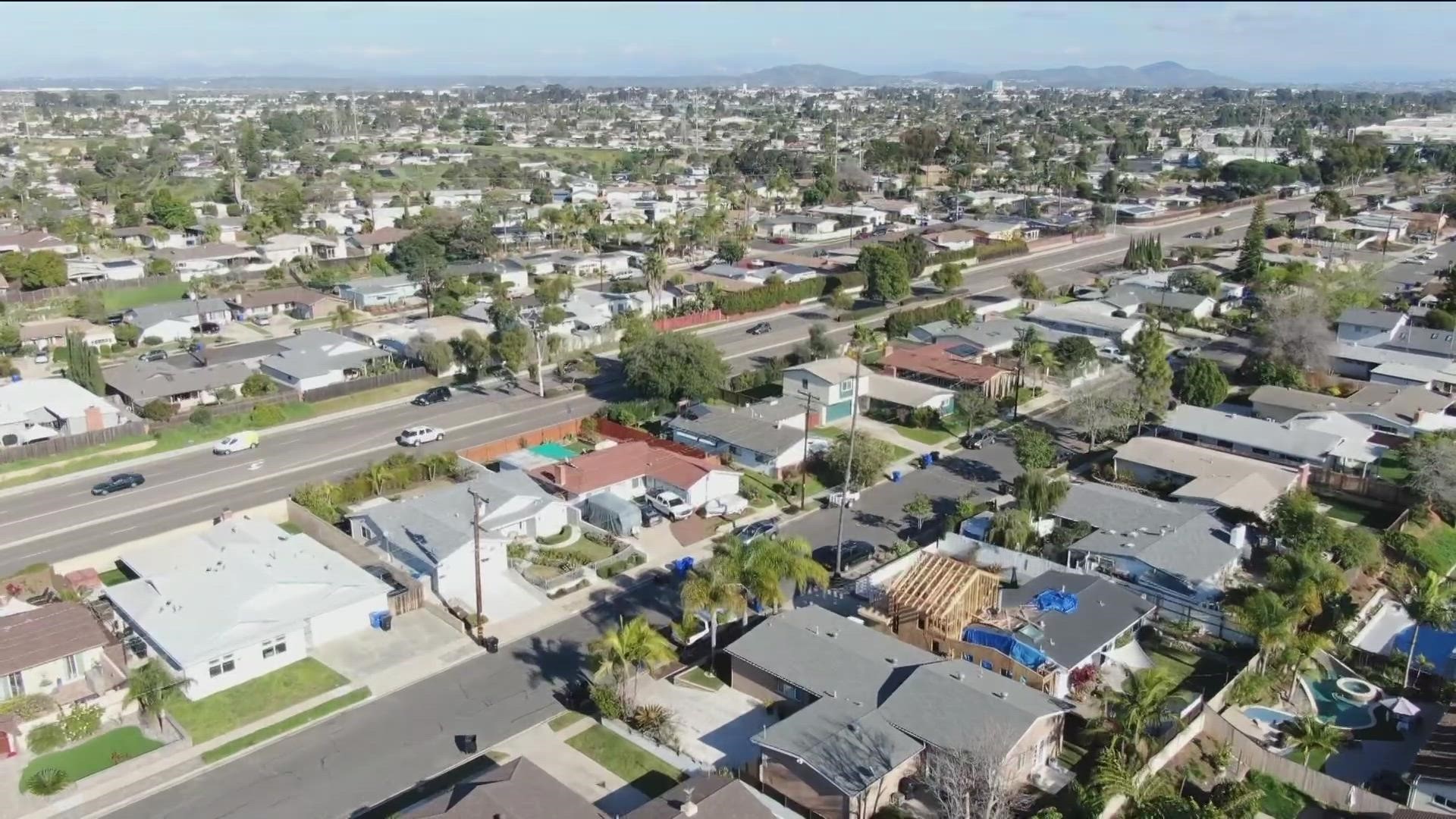

SAN DIEGO — Goldman Sachs is forecasting record drops in San Diego's home prices and says home values will fall at levels similar to the 2008 crash.

The scorching hot housing market is finally cooling down and is expected to continue through 2023.

"Nothing goes up forever and prices have gone up so much and went up so much during COVID so it has to come down," said realtor Matt Battiata.

In a note to clients earlier this month, Goldman Sachs predicted San Diego, San Jose, Austin, Texas and Phoenix, Arizona will see declines of more than 25%.

Battiata says the four cities all saw demand skyrocket during COVID. Goldman Sachs says the declines would be comparable to what was seen during the Great Recession when home prices fell around 27%. However the president of the San Diego Association of Realtors thinks differently.

"No way close to 2008. That's my professional opinion," said Frank Powell, the president of the San Diego Association of REALTORS.

He says the economic indicators just aren't there.

"As far as mortgage payments and interest rates, most people are locked in at a decent rate and paying for it," he said. "I don't see San Diego taking a huge hit."

He does expect home prices to come down and the market to stabilize itself but doesn't foresee a crash.

"I sell houses daily, I go in people's houses daily and look at mortgage rates daily," he said. "I have my hand on the pulse and I don't see that."

Powell also says San Diego's housing inventory is still low and the demand remains high which should prevent home values from crashing.

WATCH RELATED: Realtor.com releases 2023 housing market predictions (Dec. 2022).