SAN DIEGO COUNTY, Calif — More than two months ago, the San Diego region was awarded $211 million in state and federal funds to help landlords and low-income tenants who were financially impacted by the pandemic.

But only 2% of that money has been sent to eligible households, according to data obtained by inewsource in mid-May. Some are just now receiving updates about the status of their applications and many others are still waiting, housing advocates say.

The two-month turnaround to process applications and send payments to eligible households has been a problem for struggling tenants who are left in the dark. The state of California is also holding local agencies to a Sept. 30 deadline to commit 65% of the available funding.

The San Diego Housing Commission, which oversees the city’s assistance program, raised alarms in an urgent letter to Gov. Gavin Newsom last month. Rick Gentry, the housing agency’s president and CEO, said unless changes are made to the program, the city “likely will not be able to expend all of the available funding within the limited time allowed.”

Public records and interviews have revealed that while it’s true more tenants need to apply, officials are running into the same issues they encountered when the first COVID-19 rental assistance programs rolled out last year: Some landlords still aren’t taking the money, and the application process is moving at a snail's pace.

The rental and utility assistance programs prioritize those hardest hit by the pandemic — tenants who have been unemployed for at least 90 days and are considered very low income, or have a household income of less than $60,600 a year for a family of four. To be eligible, tenants must have a household income below $97,000 for a family of four and be able to show financial hardship due to COVID-19.

Records show the county’s average rent payment is almost $3,600, while the city of San Diego’s is close to $5,300.

But it has been a challenge to access that money, said Grace Martinez, director of San Diego’s Alliance of Californians for Community Empowerment. Tenants are going several weeks without any word on the status of their applications, and then are suddenly expected to work with their

landlord and provide documents within a few days’ notice. If you’re not internet savvy or don’t frequently check emails, you could easily miss out, she said.

“A lot of tenants we’re hearing are just frustrated and end up giving up,” Martinez said, adding that it has become a waiting game for most who do apply.

But for Genea Wall, 48, the application process has been more like dancing to the “Hokey Pokey,” she said, where she’s asked to provide one document and then another. The City Heights resident is a licensed insurance agent who said she has been receiving unemployment benefits since last June.

Her roommate moved out in October, leaving her to cover $2,000 a month in rent for the two-bedroom, two-bath apartment. Around the same time, she said her apartment had a bedbug infestation. She had to pay $1,600 to have it treated and is still paying installments of $183 a month for a new mattress set. All of it caused her to fall behind on bills, she said.

Wall’s landlord, Cynthia Pruitt, filed for eviction in December to pull the unit off the rental market, records show. But that case has since been dismissed. Reached by phone, Pruitt declined to comment.

By the time Wall applied for the city’s program in late March, she owed $10,000 in back rent. A month passed before she heard anything about her application. The Housing Commission first sent her an email saying she was missing verifications for income and past-due rent, and she had five days to respond. She thought it was resolved, but her rent verification wasn’t accepted and she had five days to send a new document.

Then, a few days later, the Housing Commission realized her application was also missing the past-due utility verification and gave her three days to act. The entire process took two months, but she found out late last month that her application was approved.

It’s a relief, Wall said, but she wonders what will happen once the eviction moratorium ends, because she doesn’t see a path to employment anytime soon.

The stress of the past year has caused her health to go downhill, she said. Wall has Type 2 diabetes and has started developing blisters on her feet over the past year. The wounds are getting into her soft tissue, and now she worries about the risk of amputation.

“After a while, the stress starts to manifest in other ways in your body,” she said, adding that being left in the dark about her application status only made it worse.

Few applications, dollars spent

Thousands of people in the San Diego region are still struggling to recover from the economic fallout of the COVID-19 pandemic.

A SANDAG report published last month revealed that 105,700 people in the region were still unemployed in March, more than double the pre-pandemic figures. And although an eviction moratorium has kept people in their homes, rental debt has continued to pile up in a county where census data shows nearly half of all housing units are occupied by renters.

A patchwork system of rental assistance programs helped more than 13,000 tenants in the San Diego region catch up on rent last fall. But in some cases, landlords didn’t take the money. That was happening all over the state.

This time around, California legislators passed a law that incentivized landlords. The state offered to pay 80% of any rent owed from April 2020 through the end of March 2021, if landlords agreed to waive the remaining 20%. If they refuse, eligible tenants would receive a payment for 25% of their rental debt over the same period and still be protected from eviction until June 30 — when a state moratorium is scheduled to expire.

Using the latest round of federal assistance, the state set out to accomplish two things: erase rental and utility debt for eligible low-income tenants, and give landlords most of what they are owed. The goal was to prevent mass displacement during a pandemic.

The county and the cities of San Diego and Chula Vista received money from the state and federal government because the aid was based on population. All three were accepting applications by mid-March.

As of late May, more than 27,000 people have applied and just over $11 million has been disbursed, according to officials with San Diego city and county and Chula Vista.

So far, that is a very low number of applications and it’s a problem playing out across the state, said Gil Vera, senior attorney of the housing team with Legal Aid Society of San Diego. He suspects that tenants and landlords don’t know enough about the programs.

Last fall, tenants in subsidized housing were not eligible for rent relief, because they were already receiving government assistance. Section 8 recipients in San Diego city and county are eligible for the relief this time, and officials are trying to get the word out, he said.

In addition, less than 10% of the applications in San Diego so far have been initiated by landlords. That places the burden on the tenant but also suggests that landlords don’t know they can apply to collect what they are owed, Vera added.

That was the case for Ginger Hitzke, who owns nearly 450 housing units scattered throughout the county. She said roughly 1 in 10 have past due rent, totaling up to $80,000.

Hitzke said she found out by listening to KPBS that rental property owners could apply and she jumped at the opportunity. But two months later and still no word, she said.

“I still don’t know what the heck is happening,” Hitzke said.

She said she has been doing everything she can to work with tenants, because the last thing she wants to do is file an eviction.

“I don’t want to contribute to someone maybe being homeless,” she said. “When you have an eviction on your record, it’s one of the things we look for when you apply to our apartment.”

But some tenants aren’t so lucky. Vera said some landlords aren’t willing to wait for applications to process before trying to evict.

“From their perspective, they’ve been waiting months, if not almost a year,” he added.

‘A living nightmare’

Processing applications chews up staff time and resources, said Housing Commission spokesperson Scott Marshall. For every tenant, the agency has to confirm the address, verify past-due rent and execute an agreement with the landlord. Staff then conducts quality assurance reviews to ensure payments are made to only eligible households in the right amounts, he said.

But the Housing Commission has already started encountering resistant landlords.

Records obtained by inewsource show that by mid-May the landlords of at least 26 tenants didn’t accept any money, leaving nearly $105,000 on the table. Landlords refused to accept anything other than the full amount at least five times, forgoing nearly $13,000. On the other hand, 15 tenants had landlords who didn’t respond to the Housing Commission, giving up more than $52,000.

Each time a landlord doesn’t participate, the tenant receives a direct payment to cover 25% of their back rent. As long as they use it to pay their landlord, they will be protected from eviction.

On the other hand, rental property owners don’t get 25% of what they’re owed if a tenant doesn’t participate, said Lucinda Lilley, president of the Southern California Rental Housing Association. She has one tenant that recently hit the one-year mark since her last rent payment, totaling $16,380 in debt. But the tenant refuses to cooperate and receive the assistance. In those cases, owners are left holding the bag, Lilley said.

“We are full-time housing providers,” she said, adding that many mom-and-pop owners don’t have the time to focus on this. “Could you imagine being an independent rental owner and trying to navigate this on your own?”

Gentry, from the Housing Commission, offered 10 recommendations in his letter to the governor last month. Some would help speed up processing applications, but others speak directly to property owners: cover 100% of rental debt and future payments.

Newsom has since proposed giving cities and counties more money to pay 100% of back rent owed by many low-income tenants, as well as rent for some future months.

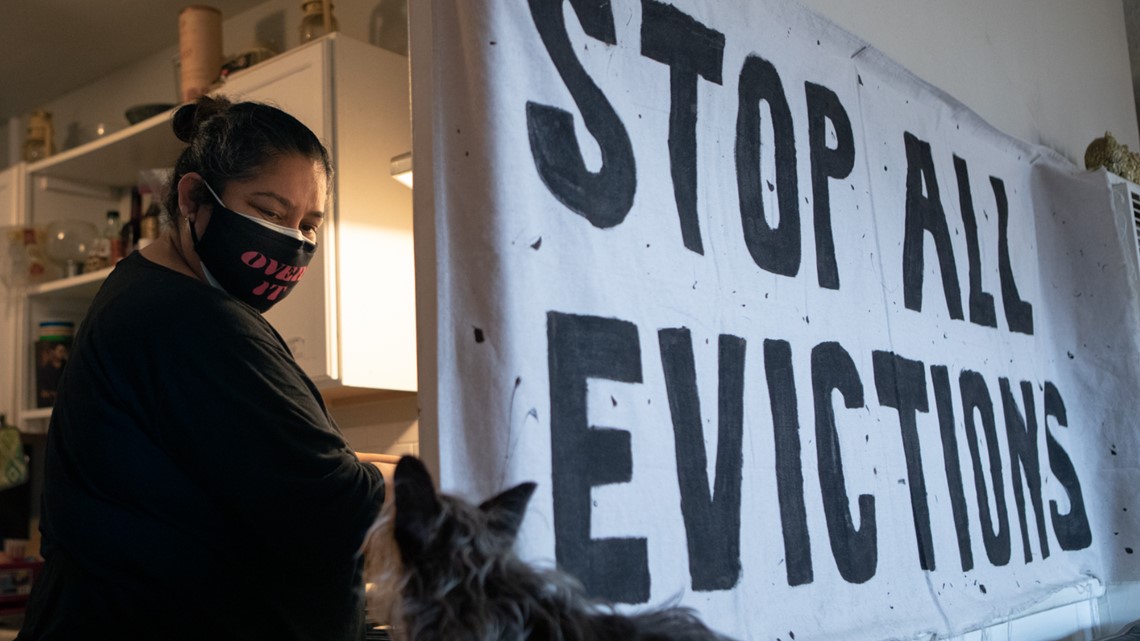

Even so, that won’t do much to help tenants like Patty Mendoza, an Imperial Beach renter and an outspoken member of San Diego’s Alliance of Californians for Community Empowerment. The mother of two was laid off from her non-emergency medical transport job last year and had to rely on the first round of COVID-19 rent relief to stay housed.

Now she has a new landlord who plans to evict her as soon as he is able, she said. Her landlord did not return calls for comment.

Mendoza applied for the county’s program in early March and learned last month that her $637 bill from San Diego Gas & Electric would be taken care of. But her rental assistance application was still processing.

A county official called and left a voicemail saying they were able to link her landlord to her application but still need him to upload documents as well as approve the past-due rent amount. Mendoza said that likely won’t happen, and she’ll have to settle for 25%. But she knows the days in her two-bedroom, one-bath apartment are numbered. It keeps her up at night, she said.

“I’m really stressed,” she said, adding that the end to the moratorium is rapidly approaching.

“What’s going to happen then? Who is going to help me then?”

“It’s been a living nightmare,” she added.

A very last resort

When the San Diego region was awarded the $211 million, it came with state and federal deadlines. Officials are supposed to commit 65% of the state’s portion of the funding to eligible households by June 1.

Officials in San Diego city and county and in Chula Vista all say they will meet that deadline.

In addition, California has to meet a Sept. 30 deadline to commit 65% or risk having unspent money recaptured by the U.S. Treasury. To prevent that, state officials are monitoring the pace and volume of eligible applicants received by each local agency, and then projecting that agency’s ability to spend the money in time, said Russ Heimerich, a spokesperson for the state Business, Consumer Services and Housing Agency.

“If we cannot reasonably show a projection that meets the (Sept. 30 deadline), then we would be forced to adjust funding to make sure no funds are recaptured by the U.S. Treasury,” Heimerich said. But this would be a “very last resort,” he added.

Heimerich stressed that the problems facing the San Diego region are also playing out across the state. Newsom’s proposed changes to the law, especially covering 100% of back rent, will “significantly increase the volume of applications and the volume of money going out the door,” he said.

Based on the San Diego region’s current rate, as well as an anticipated jump in applications as a result of Newsom’s proposed changes, it’s looking like the region will meet that Sept. 30 deadline, said Geoffrey Ross, deputy director for federal programs at the state’s Housing and Community Development Department.

On the other hand, not everyone is critical of the region’s efforts to send money to struggling families.

Christine Palmer-Jenkins is a regional property manager who oversees 12 affordable housing complexes with a total of 509 units. She said county staff members are doing the best they can under the circumstances.

“I know owners would like to have their money now,” she said. “But from where I’m sitting, no one has ever done this before. No one has ever experienced this kind of huge need that they were going to have to address really quickly.”

Palmer-Jenkins said any hiccups that might come along the way — such as county staff asking for documents it should already have on file, therefore duplicating her efforts and dragging out the process — can be chalked up to these unprecedented circumstances.

By late May, she started seeing some movement.

“As I’m talking, almost everyone has been approved that we requested,” she said. “Now, it did take two months.”

inewsource is a nonprofit, independently funded newsroom that produces impactful investigative and accountability journalism in San Diego County. Learn more at inewsource.org.

Watch: Inewsource investigation uncovers San Diego has only sent out 2% of rent relief to eligible households