SAN DIEGO — It's disappointing news for people who have been trying to buy a home but haven’t been able to because of costs.

Economists said this rate jump deepens the affordability crisis for homebuyers, and it discourages people from moving—even if it’s for a better job.

Mortgage rates have jumped this year partly because the Federal Reserve raised its benchmark rate several times in an attempt to cool inflation.

Economists said higher borrowing costs — paired with elevated prices — have also made home buying unaffordable for a large portion of buyers.

They also said higher mortgage rates have contributed to the decline in mortgage applications and home sales.

That is also why many sellers have withdrawn from the market.

The rate jump is concerning for families who feel they won’t qualify to buy a home—especially as median home prices have remained high.

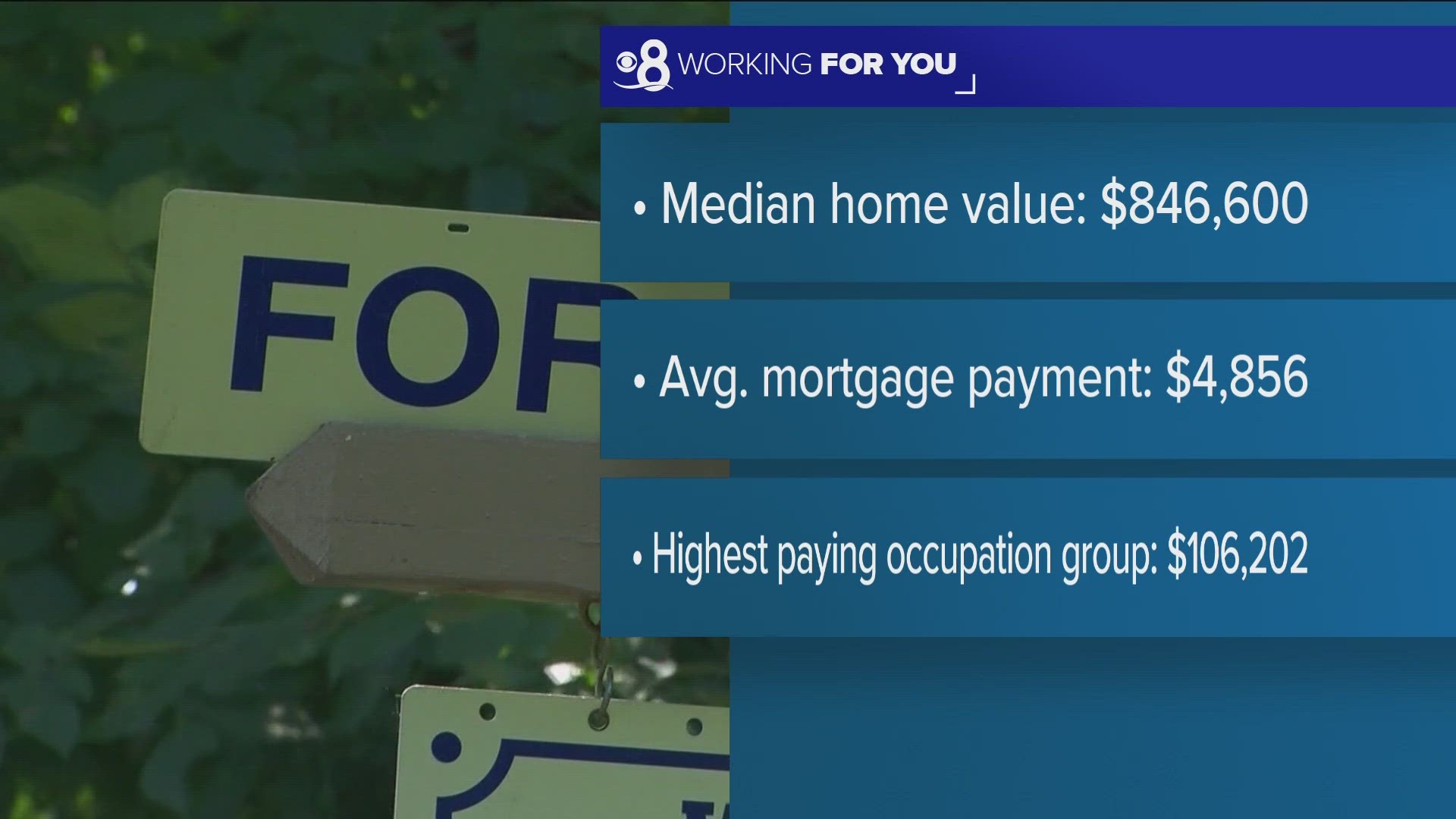

This comes at the same time that San Diego has been ranked the third city to have the least affordable housing while working in higher paying jobs, according to Lending Tree.

In a study, Lending Tree calculated “affordable” mortgage payments based on the 28% rule.

It suggests that borrowers should spend no more than 28% of their gross monthly income on their monthly mortgage payments.

They found that in San Diego, a mortgage on a median-value home could cost nearly 28 hundred and 23 hundred more than what workers in the highest-paying occupation groups could comfortably afford.

There is some hope. Economists said with mortgage rates jumping there's been more room for negotiating, even if they are not posted as such online.

For more information visit:

California Dream for All Shared Appreciation Loan | California Housing Finance Authority

San Diego Housing Commission | Information for Homebuyers