SAN DIEGO — People looking to retire early need to do more than just save. A new GOBankingRates analysis found how much is needed in every state to retire at age 50, and unsurprisingly, California is the second highest.

Breakdown

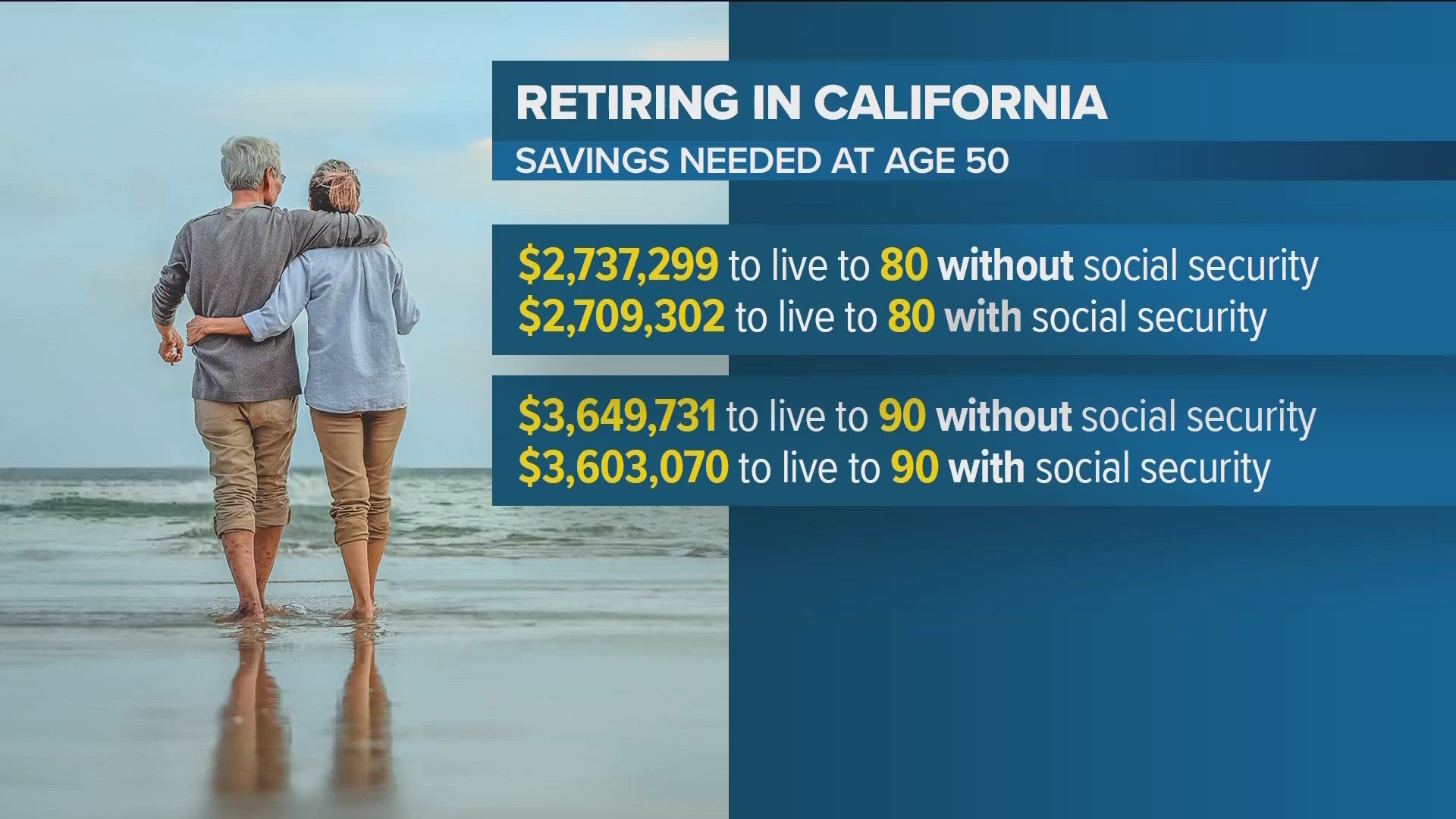

The analysis found you need at least $2.7 million to retire at age 50 in California.

- $2,737,299 to live to 80 without social security

- $2,709,302 to live to 80 with social security

- $3,649,731 to live to 90 without social security

- $3,603,070 to live to 90 with social security

Andrew Murray was the lead analyst on the GOBankingRates analysis. The Bureau of Labor Statistics data used in the analysis was collected July 1.

"We took people born 1965 to 1980, what they're spending and kind of extrapolated that out for monthly and annually by state, and then we took those figures and kind of just multiplied them out," Murray said.

Murray said the biggest factors driving the cost in California is home, mortgage, car, gas and food prices. He said having a financial plan is crucial when saving for retirement.

"I think there are so many rules you can go by, and especially for retirement, where you should have 25 times whatever you think your annual expenditures are going to be by the time you retire," Murray said.

Other saving suggestions from GOBankingRates include speaking to a financial advisor, increasing your income and making lifestyle changes.

Even with saving, retiring at 50 is not realistic for most people.

"More and more more people, when I talk to them, aren't talking about retiring early," Murray said. "They're hoping to retire at all."

Murray said building savings is important for planning to retire at any age.

"Just making sure you're always pushing towards that goal, even if you might not be pushing as hard as someone who wants to retire at 50, you should always be moving in that direction, towards saving more and more for retirement," he said.

WATCH RELATED: Affordable housing tenants fight back after corporate landlord issue massive rent hike