SAN DIEGO — Everything seems to cost more these days, which means people need to make tough choices on what they spend their money on and what things they cut from the list.

"I don’t get my nails done as often. I haven’t gotten them done in about 2 years," said San Diegan, Debra Johnson.

"Just leaving the house and just go out less and stay home more and saving money that way," said El Cajon resident, Cesar Williamson.

"I'm more selective about where I go eat because prices are up," said San Diegan, Ana Verdin.

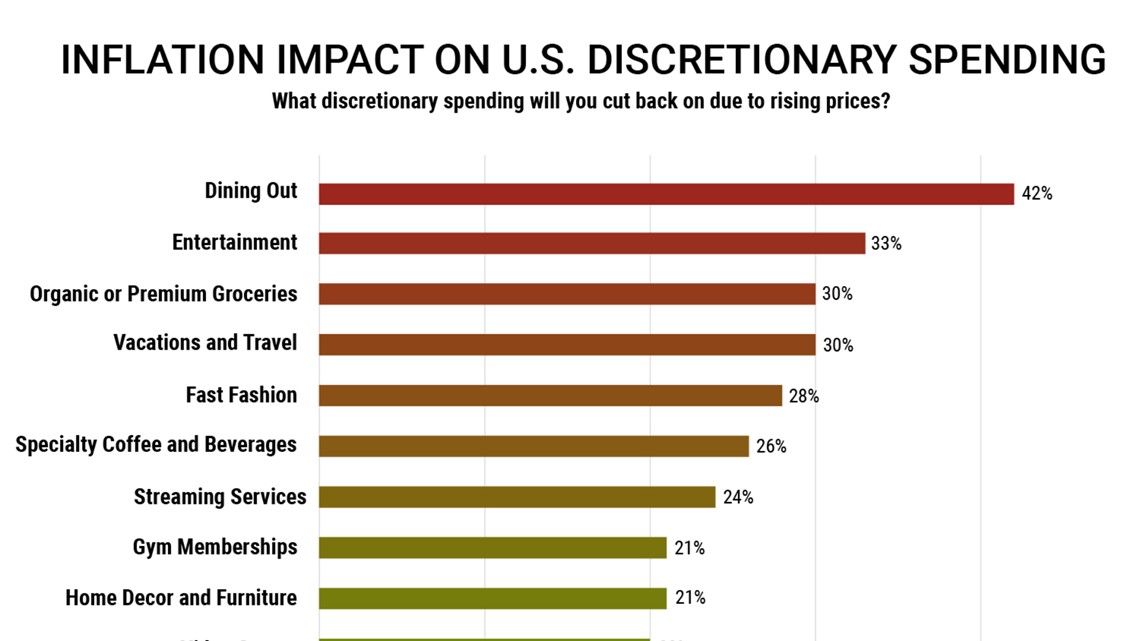

A new report by New First Insight shows what people have cut back on most across the country due to the impact inflation has had on their wallets.

42%of consumers are saving on eating out.

33% percent are cutting back on entertainment costs while 30% are reducing their spending on groceries.

Yet, many people in El Cajon say they aren’t passing up on eating out. "No, I was at another restaurant last night and I'm here today. I'm not cutting back on restaurants that’s for sure," said Kathy Box.

"I don think any amount of inflation would stop us from coming here. Every Sunday for about 3 years, we would never give that up," said Liz Phelps, a loyal customer of Por Favor in El Cajon.

While some restaurants may have more empty seats, people say they are staying home more often to save on gas.

"We have good days and bad days. We used to be open 7 days a week and now we are open only 5 days a week," said Slyvia Ursino who has worked at Por Favor for more than two decades.

"I don’t go all over town like I used to. I try to make my trips count. Fuel prices are higher. I go out for a mission, not just to shop," said Johnson.

In contrast, the data shows there are things consumers are refusing to give up on: beauty products and pet services top that list.

"I would not cut back on things like getting my dogs groomed," said Box.

"Coffee! Beauty products! Or getting hair done, stuff like that. Those are necessities," said Verdin.

"We wouldn’t give up travel. We went down on going out. We might not do that because I force him to cook," a Por Favor restaurant customer laughed.

RELATED: Souplantation to reopen in La Mesa

According to the report, consumers also are reducing their spending on travel, gym memberships, and furniture.

"Just because we're having inflation, I'm still going to live my life and budget in other ways and not stress about it," said Williamson.

The majority of people seem to be saving on gas, but trends always change as consumers deal with the highest inflation rate in 40 years.

According to First Insight, the report is based on a sample of 1000 people fielded by email in April 2022. The sample was proportionately balanced by generation, region, and gender.

WATCH RELATED: US inflation slowed last month from 40-year high and after seven consecutive months of worsening price increases: