SAN DIEGO — The U.S. Attorney's Office and San Diego FBI have recovered millions of dollars lost by elderly fraud victims.

The U.S. Attorney of California's Southern District Tara McGrath says this latest recovery is the result of reporting suspected fraud early, allowing investigators to seize money before it's all gone.

"The faster that a victim reports, the more likely we are to recover the funds," said McGrath.

Starting in January of this year, McGrath's office teamed up with the FBI, local and state agencies to start a new and aggressive effort to thwart criminals who target seniors.

To date, they've recovered $3.3 million by freezing the accounts victims' money has been transferred to and taking it back.

"If you think you're a victim and you report within 12 hours, we've got a good chance of getting the money back, or at least freezing it. If it's been more than a week, the money's probably gone. But, that doesn't mean that victims shouldn't report, because the information helps law enforcement," said McGrath.

Despite the program's recent success, McGrath says it's a small fraction of the overall loss.

California was reported to have had both the highest number of victims and also the highest dollar amount lost in 2023. The FBI reported Californians lost roughly $2.1 billion.

McGrath says in San Diego County alone, it's believed victims of elder abuse lose between $3-6 million every month, though it could be more since these types of crimes often go unreported.

"There's a lot of stigma to reporting, which is part of the reason why we're trying to get the message out, anyone can be a victim."

In addition to reporting fraud, McGrath says first and foremost, people need to know what to look out for.

Scams originate via email, text messages and phone calls.

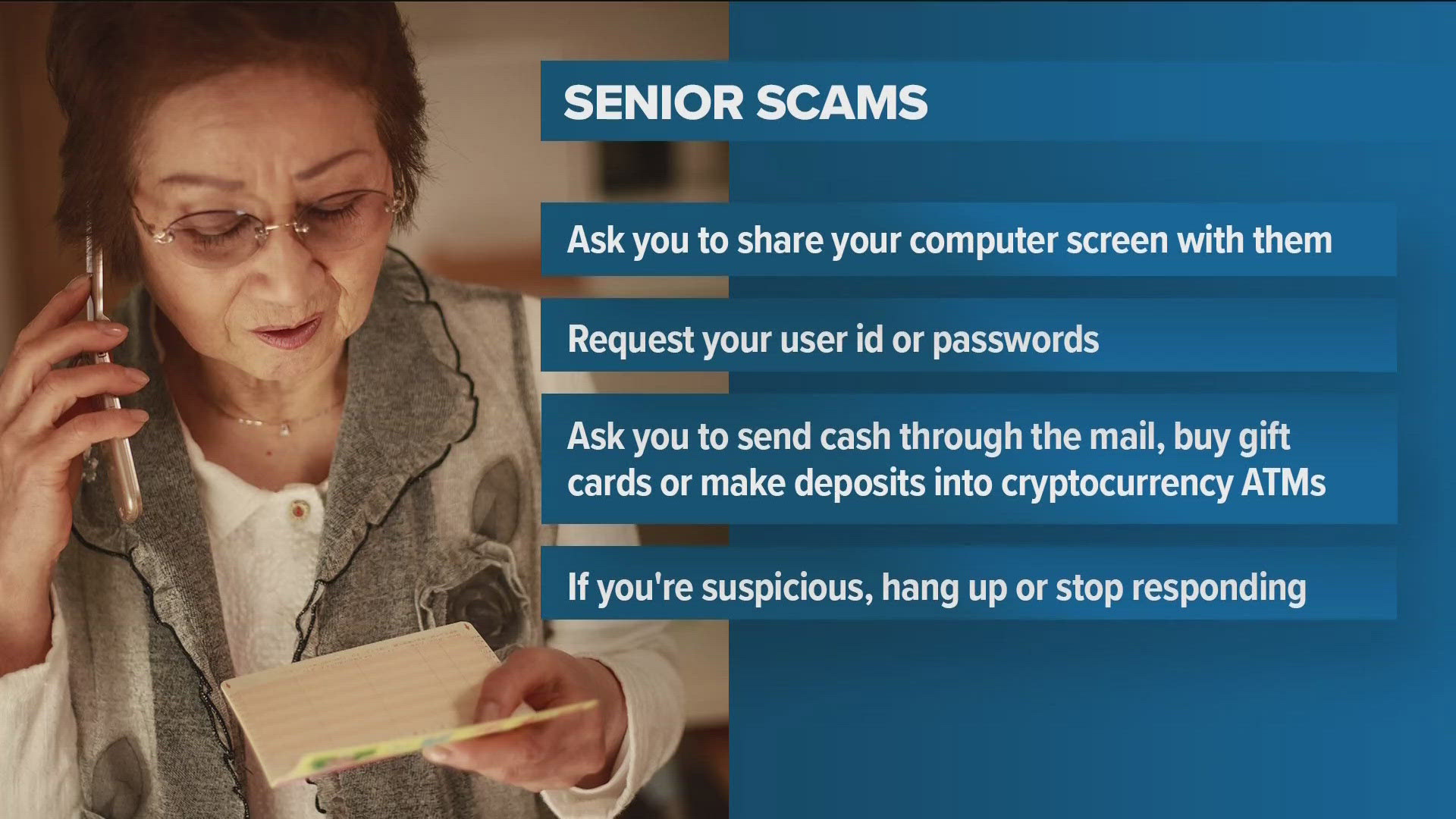

Legitimate companies do not typically:

- Seek to access to computers or phones remotely.

- Request that customers provide User ID or Passwords for the representative to log into your account for you.

- Ask customers to send cash through the mail, deliver gold bars or precious metals, or make deposits into cryptocurrency ATMs.

- Ask customers to mail money or wire funds in order to refund alleged overpayments.

If you're suspicious, hang up or stop responding until you've called your bank or the company in question to double check.

"If they're legitimate, they'll be okay with it. They will want you to be sure that what you're doing is safe. And if they're not legitimate, then they'll try to keep you hooked. No, no, no, you don't need to do that. This is urgent," said McGrath.

If you think you've been contacted by a scammer, report it quickly at IC3.gov.

Other ways to help prevent elder abuse and neglect include:

- Listen to older adults and their caregivers to understand their challenges and provide support.

- Check-in on older adults who may have few friends and family members.

- Look for unusual financial transactions – unexplained withdrawals, purchases of gold bars or cryptocurrency, or uncharacteristic efforts to wire large amounts of money.

- Report abuse or suspected abuse to local adult protective services, long-term care ombudsman, or the police.

For other non-life-threatening emergencies, call the National Elder Fraud Hotline at 1-833-FRAUD-11, or go to the Department of Justice's Elder Justice Initiative website for more information.

WATCH RELATED: Senior citizen loses $15,000 to alleged landscaping scam in San Diego