SAN DIEGO COUNTY, Calif. — If you're looking to buy an electric vehicle, there are some things to consider when deciding whether or not to get one now before the end of the year or wait until 2024. As electric vehicles continue to evolve, so too are the tax incentives that come along with them.

For example, if you look up Tesla's Model 3, on Tesla.com, you may notice a message stating the $7,500 federal tax credit could be reduced by half in 2024.

"The tax incentive for alternative fuel vehicles is always shifting and moving around,” said Karl Brauer, an executive analyst at iseecars.com, an online automotive search engine and research website. Brauer explained the Inflation Reduction Act, which Congress passed in August of 2022, limited full credits to cars with battery components and raw materials that come from the United States or a free trade partner.

Those restrictions get stricter each year, and Tesla believes it may not qualify for half of the $7,500 credit with next year's tightening of restrictions.

"They want the battery production in the U.S., so a certain amount of cars fell out of the $7,500 federal tax incentive," said Brauer.

Because of this, you may see some companies, including Tesla slash prices to make up for those lost incentives.

Chris George, General Manager of Team Kia of El Cajon says because Kia's don't qualify, they've found other ways to pass along $7,500 in savings to customers. “When you lease a vehicle say from an import, or our brand, they match that in their lease program," said George.

George says he's confident those incentives aren't going away anytime soon, so there's no rush to buy now versus later.

But, there is another change coming in 2024 that could sway you to wait.

Starting next year, that $7,500 tax incentive will be offered right away via the dealership as opposed to months later when filing taxes.

"So, you fall in the adjusted gross income of 50-60,000 dollars, you may not be able to use the full tax credit because you don't have a big enough tax liability, so this is really a benefit for the consumers in 2024," said George.

"Instead of paying fewer taxes, when you file your return, you'll pay less for the car when you buy it," said Brauer.

Both experts recommend that you do your research to ensure your income bracket qualifies for a rebate.

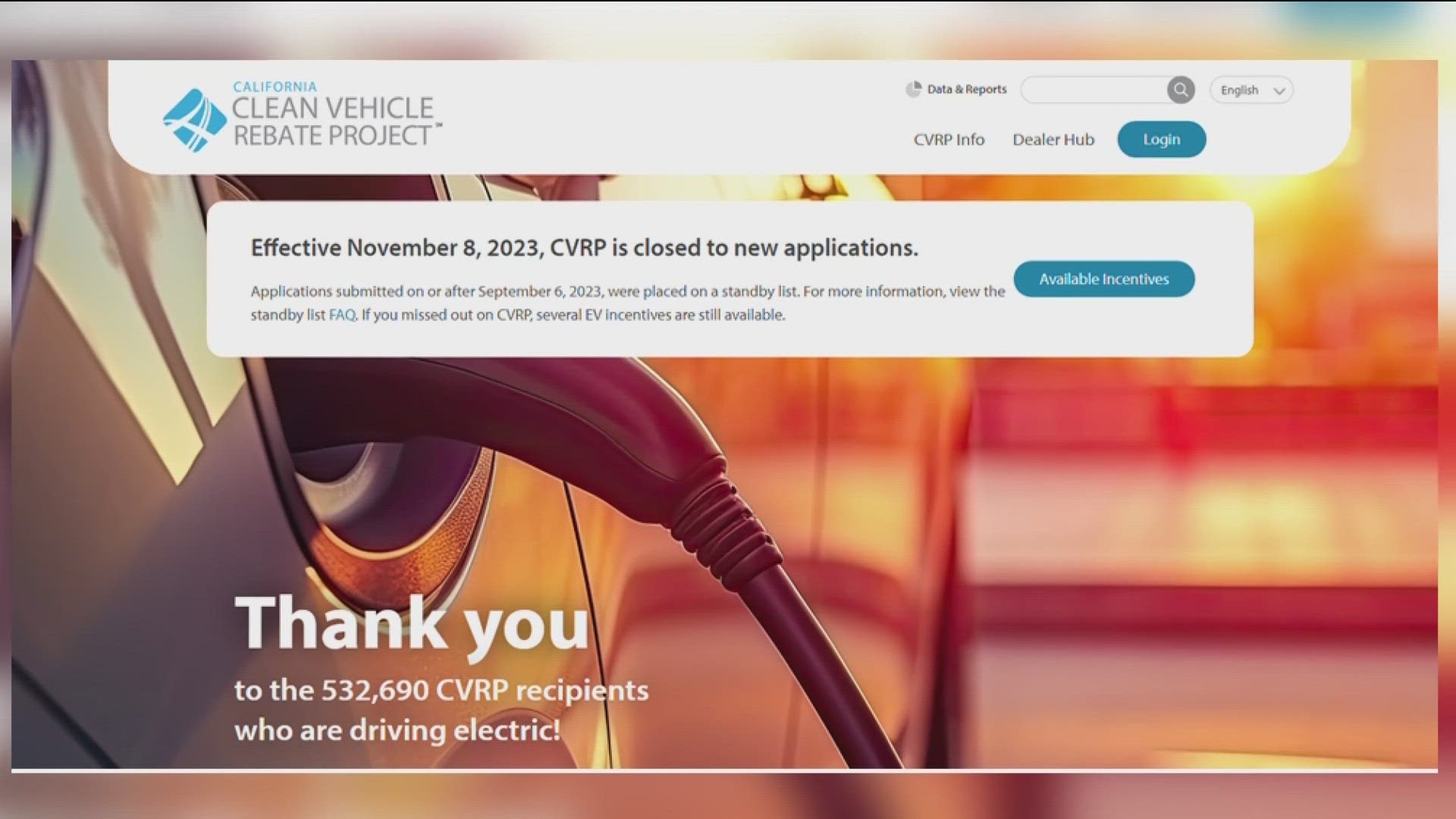

Another thing to consider, California, which offers additional rebates for electric vehicles is no longer accepting new applications. Instead, in 2024, they plan to provide subsidies only to low-to-middle-income residents, who have more trouble affording electric cars.

WATCH RELATED: How to find out if you qualify for a tax rebate for your electric vehicle (Jan 2023)