SAN DIEGO — Under California law, insurance companies must give a 75-day notice of nonrenewal before they can drop property insurance due to wildfire risk.

That should give your condo association plenty of time to start looking for replacement policies.

But brace yourself. The replacement policy will be much more expensive.

“A lot of these homeowners associations have dozens of units, and they need tens of millions of dollars in coverage,” said Grant Moseley, an insurance expert with Utopia Property Management in Kearny Mesa.

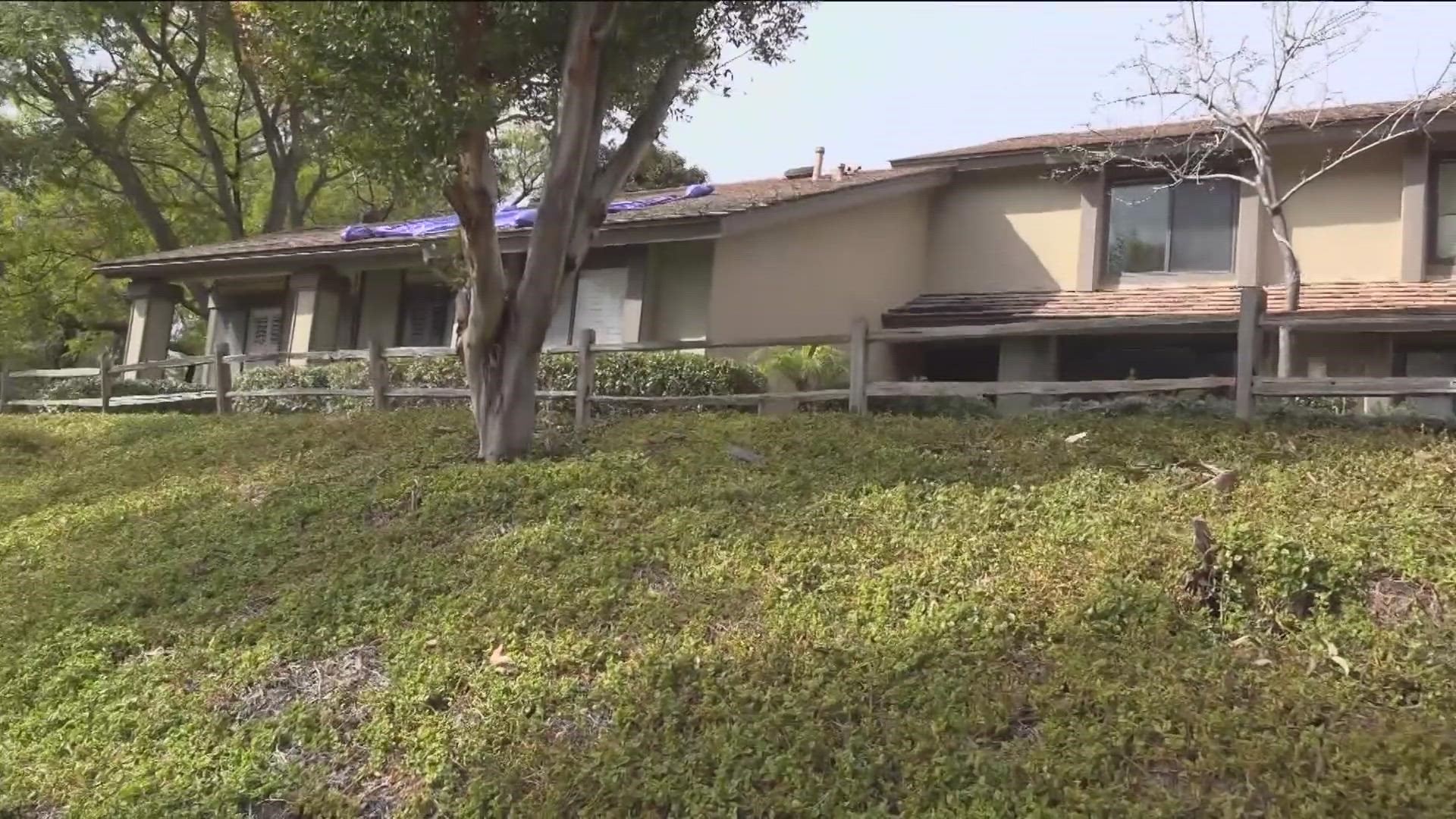

As CBS 8 has reported, Farmers Insurance recently dropped policies on at least four condo complexes in San Diego due to wildfire risk, leaving more than 1,000 homeowners without property insurance.

Following nonrenewal, condo associations will typically turn to an insurance broker to cobble together a replacement policy on the surplus market with a higher premium for less coverage, sometimes insufficient coverage.

“The real concern is how are they going to sell their units when a mortgage company isn't going to lend on a property that's not insured? I don't think homeowners are going to be able to sell them,” said Moseley.

While the insurance industry touts wildfire mitigation as a solution to the problem of condo complexes being dropped, Moseley said spending money on brush clearing or structure hardening will not guarantee the complex will be re-evaluated or the insurance renewed.

“As much as I hate to say it, it's probably futile. They have basically high-risk fire zone models. They could clear it (brush) for five miles, and put all the fanciest roofs on there, and gutter guards, and coat protect the eaves and all that; they're going to decline it anyway. It's really an exercise in futility, unfortunately,” said Moseley, who said he worked for 23 years as a Farmers Insurance agent.

Moseley believes the best advice if your condo association’s master policy is dropped is to start looking as soon as possible for other carriers.

“It's really a crapshoot on who's going to pick it up. The one thing that's certain about insurance is it's uncertain,” said Moseley.

One solution for single-family homeowners, the California FAIR Plan, is a policy of last resort, which only covers fire insurance. But the FAIR Plan’s maximum coverage limits are not high enough to cover most condo complexes under a master property insurance policy.

WATCH RELATED: Insurance industry pushes wildfire mitigation as solution to condo crisis (Feb. 2023).